NATS Defined Contribution Pension Scheme

Annual Report for the year ended 31 December 2021

Chairman’s Statement

I am pleased to present the Trustees’ statement of governance, covering the period 1 January 2021 to 31 December 2021. This statement describes how the Trustees seek to ensure that the NATS Defined Contribution Pension Scheme (the ‘Scheme’) is well-managed and delivers excellent services to members. The statement examines four key areas of the Trustees’ governance, namely:

- The investment strategy relating to the Scheme’s default arrangement;

- The processing of core financial transactions;

- Charges and transaction costs within the Scheme including the pounds and pence illustration of the compounding effect of charges;

- Net Performance (after charges and transaction costs are accounted for);

- Value for Members; and

- The Trustees’ compliance with the statutory knowledge and understanding requirements.

In doing so, we provide the various statutory disclosures required by the Occupational Pension Schemes (Charges and Governance) Regulations 2015.

Monitoring the overall quality of the Scheme arrangements is a complex task that the Trustees take seriously, and are supported in this process, as well as the day-to-day business of running the Scheme, by Aegon (the provider of administration, investment and some of the communication services for the Scheme) and independent advisors, covering governance, investment advice and wider DC matters. The Trustees also recognise the valuable support which is provided to the Scheme by the Company within the HR and payroll functions.

It is important to emphasise, that this Statement does not contain advice in respect of actions that members should or should not take and is not intended to be used for that purpose. If members need advice, they can find details of how to obtain advice can be found at www.fca.org.uk/consumers/finding-adviser.

1. Default Investment arrangement

The Trustees’ Statement of Investment Principles (SIP) adopted on 26 August 2020 is attached. This has been prepared in line with Regulation 2A of the Occupational Pension Schemes (Investment) Regulations 2005. In line with the Trustees’ requirements, the latest version is available on a publicly available website, https://www-aero-nats.m-w.site/home/nats-defined-contribution-pension-scheme/, and is also available to members on request. This covers the aims and objectives in relation to the default investment arrangement as well as the Trustees’ policies in relation to matters such as risk and diversification. Additionally, it states why we believe the default investment arrangement to be the most appropriate for the membership of the Scheme.

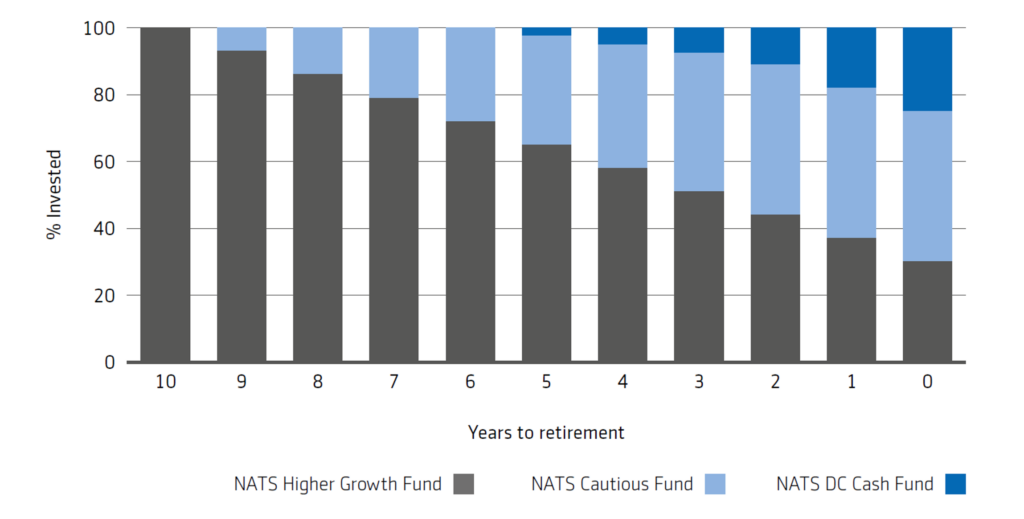

The current default lifestyle strategy, the Income Drawdown Lifestyle, was introduced in March 2018. This is a lifestyle strategy which invests 100% of members’ assets in the NATS Higher Growth Fund (a fund diversified across asset classes, but with a bias towards equities) up to 10 years prior to normal or selected retirement age.

At this point a proportion of the assets is gradually switched into the NATS Cautious Fund (a fund diversified across asset classes, but with a bias towards bonds) before introducing an allocation to the NATS DC Cash Fund in the last 6 years prior to retirement.

At retirement, 25% of the assets are invested in the NATS DC Cash Fund, 30% in the NATS Higher Growth Fund and 45% in the NATS Cautious Fund. This option is designed for members who are planning to take the maximum tax free cash lump sum and access the remainder of their savings via income drawdown.

The Trustees also believe that a default strategy that maintains a well-diversified investment portfolio in the run up to retirement provides the best compromise against potential risks and ensures individuals are well equipped to navigate their options.

Members intending to take their retirement benefits through other formats have the option of two additional lifestyle strategies or building their own bespoke investment strategy from the self-select fund range. Members are supported by clear communications regarding the aims of the default and the alternative investment options available.

The last full review of the investment arrangements including the default option was completed on 16 November 2021.The review covered the following areas:

- The default arrangement in the Scheme, with a particular focus on the at-retirement target of the Scheme’s main default arrangement, the makeup of the growth and de-risking phases and whether these remained appropriate.

- The profile of the membership, Scheme experience and the latest industry trends on how members are accessing their savings at retirement.

- The ongoing suitability and performance of the current default investment option in line with the Trustees’ aims and objectives.

- The self-select fund options available to members and whether there were any further fund options that might be appropriate to add or remove.

Following the review, the Trustees concluded that there were no changes required to the default option as they were comfortable that the Income Drawdown Lifestyle strategy remained suitable as the default investment arrangement. The Trustees also concluded that no changes to the self-select fund range were warranted at this time, but would keep the matter under review.

In addition the investments (fund type, management style and asset allocations) used in the default strategy were continually assessed during the year to 31 December 2021 as part of the periodic performance evaluation, and to ensure the kinds of investments held in the default strategy were consistent with the SIP.

The Trustees will continue to monitor the suitability of the default option and it will be reviewed every three years or sooner if necessary, for example if there are significant changes in the Scheme’s demographic profile. The Trustees have also continued to review the fund managers under the Scheme considering possible options from alternative managers in the period since the last formal review.

The Trustees continue to review the performance of all the funds available to members and risk-based reviews are undertaken on a quarterly basis. The Trustees’ Investment Consultant also keeps the Trustees abreast of all the relevant developments in the DC pension arena.

Environmental, Social and Governance Factors in Investments

Following the DWP’s requirements which came into force on 1 October 2019, the Trustees reviewed and updated the SIP setting out how they take account of financially material considerations, including Environmental, Social and Governance (ESG) considerations, and explicitly climate change. In addition, in line with the requirements, the SIP also includes the approach to the stewardship of the investments and how the Trustees take account (if at all) of member views on ‘non-financial matters’. Additional updates were made to the SIP ahead of further requirements from 1 October 2020, which included additional disclosure requirements around the Trustees’ policies in the SIP and addressing stewardship in more detail.

In terms of monitoring ESG issues within the current fund range, the Trustees’ Investment Consultant provides ESG fund ratings on a quarterly basis. These ratings represent the extent to which managers integrate ESG factors and active ownership into their core processes.

In addition, the Scheme offers the Aegon Shariah Fund (HSBC Islamic Global Equity Index Fund) as an option to members who wish to invest according to particular religious principles. The Scheme also offers the Aegon Ethical Fund as an option to members who wish to invest ethically or sustainably.

The Trustees undertook ESG training on 15 October 2021, which covered a range of topics including responsible investment, stewardship, climate change, sustainability, and the importance of incorporating ESG considerations into the scheme’s pension arrangements. Whilst no changes were made to the investments as part of the last investment review, the Trustees have agreed to monitor developments in this area further in 2022 within the confines of the funds made available to the Scheme by the platform provider.

2. Core Financial Transactions

As required by the Administration Regulations, the Trustees must ensure that core financial transactions are processed promptly and accurately. Core financial transactions are (broadly):

- Investment of contributions made to the Scheme by members and their employer(s);

- Transfers into and out of the Scheme of assets relating to members;

- Switches of members’ investments between different funds within the Scheme; and

- Payments from the Scheme to or in respect of members (e.g. payment of death benefits and on retirement).

The Trustees recognise that delay and error can cause significant losses for members. They can also cause members to lose faith in the Scheme, which may in turn reduce their propensity to save and impair future retirement outcomes. We therefore operate measures and controls aimed at ensuring that all financial transactions (such as benefit payments and switches between funds) are processed promptly and accurately.

The Trustees have appointed a professional bundled pension provider and have delegated the day to day running of the Scheme. However, the Trustees are aware that the responsibility of the running of the Scheme remains with them and they have implemented adequate internal controls, which are reviewed periodically. Core financial transactions have been processed promptly and accurately as a result of the following actions:

- The Trustees use a reputable professional pension administration provider – Aegon.

- The Trustees have appropriate service agreements in place with the administrator and are aware of their key contacts. Such service agreements cover all core administration processes and incorporate performance standards, including timescales for completing tasks. These standards are monitored by the Trustees on a quarterly basis. The Trustees are committed to monitoring service to ensure that members receive service in line with expectations.

The Trustees have delegated the administration of Scheme member records to Aegon. The Trustees have agreed minimum timescales with Aegon for processing requests, including core financial functions, which are well within any applicable statutory timescales. The following Service Level Agreements (SLAs) for the core financial transactions have been agreed:

| SLA | Description | Target Service Level % |

| 1 working day | Possible claim identified | 90% |

| Transfer out claim | 90% | |

| Contribution schedule in | 100% | |

| Switch Request | 100% | |

| 2 working days | BACS Payment in | 100% |

| 3 working days | Member change group | 95% |

| Change payment details | 95% | |

| Change salary details | 95% | |

| Change target retirement age | 95% | |

| 4 working days | Single contribution | 95% |

| 5 working days | Retirement | 90% |

| Contribution refund | 95% | |

| Death claim | 95% | |

| Transfer out | 95% | |

| Transfer in | 95% | |

| 6 working days | Transaction reversal | 98% |

Aegon records all member transactions and benefit processing activities in a work management system which assigns the relevant timescale to the task.

From 1 January 2021 to 31 December 2021, an overall service level for core financial transactions of 95.6% was achieved by Aegon compared with a target level based on actual activity of approximately 94.5%. The Trustees have continually monitored the position with regular updates from the administrator and are satisfied with the service delivery during the year.

As a wider review of the Scheme administrator in general, the Trustees receive details of the administrator’s control procedures which govern the accuracy of their processes. The administrator employs an independent auditor to prepare an annual report on their internal controls (AAF01/20). The report to 30 September 2021, which has been shared with the Trustees, confirmed that the administrator’s description of their control procedures over their administration and governance activities was fairly presented and that controls were suitably designed. No exceptions were noted.

Core financial transactions – summary of processes and controls provided by Aegon to the Trustees in their quarterly reporting:

- All processes including core financial transactions are conducted in accordance within a strict governance framework that complies with International Standard on Assurance Engagements 3402, “Assurance Reports on Controls at a Service Organisation”.

- The documentation received in support of all financial transactions requested on a member’s account is fully reviewed for completeness before processing may commence.

- Checklists are in place to help ensure that all necessary information for financial transactions has been received and that all regulatory and service level requirements have been met.

- Checklists are reviewed by a senior administrator. A senior administrator will also review the financial transactions that have been keyed into the record keeping system for completeness and accuracy.

- Financial transactions include contributions, switches, refunds, transfer out payments, deaths and retirements. All requests for financial transactions are scanned into our work management system and tracked to ensure that they are actioned on a timely basis and completed in accordance with agreed service standards.

- A daily report is run to verify that the dealing deadline is met. This report identifies members with a partially processed transaction and identified cases are investigated and actioned appropriately.

- Two further reports are run regularly to ensure that accounts are maintained in accordance with all relevant regulatory and scheme requirements.

Reconciliation of member contribution and investment records – provided by Aegon to the Trustees in their quarterly reporting:

- All contributions are submitted through our online portal. The contributions are checked against expected contributions due and any variances by plus or minus 10% are investigated and the appropriate action taken to resolve any issues.

- Before single contributions are invested, an Authority to Bank form is completed to confirm that the relevant Know Your Client/Anti Money Laundering checks have been performed and this form is checked by a senior administrator.

- A daily checklist is run by our dealing team to verify that all dealing activities are completed accurately and on a timely basis. The checklists cover the dealing, pricing and reconciliation functions of the team.

- Dealing activities with guest fund managers include authorisation by two approved signatories.

- Daily holdings reconciliations are carried out between the recordkeeping system and the Dealing system to highlight any differences. Any exceptions are investigated and resolved and reviewed by a senior administrator.

In addition to the above processes:

- The Trustees identify, evaluate, manage and monitor risk. By incorporating risks identified in relation to core financial transactions into the risk register, they are categorised and prioritised.

- The Trustees can confirm that there are close working links between the in-house Human Resource, Payroll and Reward teams and the administrator, and they monitor the timely payment of contributions within the quarterly report.

- Any administration errors will be resolved and managed within timescales agreed with the Trustees.

- The Trustees require the administrators to provide quarterly stewardship reports.

- All documents are scanned and saved electronically. All electronic files are backed up on a daily basis with copies stored off site.

- All financial transactions are subject to annual audit requirements as part the Trustees Annual Report and Accounts.

- The Trustees commission periodic internal audit to check that controls are in place

- Detailed disaster recovery plans are in place with the administrator, other relevant third parties and within the sponsoring employer.

Based on the above, the Trustees are satisfied that during the period to which this Statement relates:

- the administrator was operating appropriate procedures, checks and controls and generally operating within the agreed SLAs;

- there have been no material administration errors in relation to processing core financial transactions that have been brought to the attention of the Trustees and not addressed to ensure no member prejudice; and

- the Scheme’s core financial transactions have generally been processed promptly and accurately by the administrator.

3. Costs and Charges borne by members

There are two main types of costs and charges borne by members – the Total Expense Ratio (TER) and transaction costs. The Trustees have followed statutory guidance when preparing this section.

TERs are explicit charges which consist principally of the manager’s annual charge for managing and operating a fund, but also includes the costs for other services paid for by the fund, such as the legal costs, registration fees and custodian fees. However, they exclude other costs that are also member borne and which can therefore have a negative effect on investment performance such as transaction costs and interest on borrowings.

Transaction costs are the expenses associated with a member trading in and out of a fund as well as the investment manager trading a fund’s underlying securities, including commissions and stamp duty.

The fees met by members remain compliant and are within the 0.75% p.a. charge cap on defaulted investment arrangements. The fees in place at 31 December 2021 are detailed in the table below: the funds in bold make up the current default arrangement, the Income Drawdown Lifestyle and the individual components are also available to invested in separately.

The Trustees have obtained details of the transaction costs applicable to the investment funds from Aegon. The transaction costs provided by the Scheme’s investment managers have been reported separately to the Annual Management Charge (AMC).

| Fund | Underlying Fund | Annual Management Charge (AMC/TER) (% p.a.) | Transaction costs (% p.a.) a |

| NATS Higher Growth | 40% NATS Global Equity 60% NATS Diversified Growth |

0.59 / 0.60 | 0.17 |

| NATS Diversified Growth | 33.3 % BlackRock Newton Real Return 33.3 % Invesco Global Targeted Returns 33.3 % Legal and General Investment Management Diversified Fund |

0.83 / 0.84 | 0.29 |

| NATS Cautious | 50% NATS Diversified Growth 50% BlackRock DC Retirement |

0.51 / 0.52 | 0.17 |

| NATS Pre-Retirement | 75% BlackRock DC Retirement 25% BlackRock Cash |

0.17 / 0.18 | 0.05 |

| Aegon Ethical | Kames Ethical Equity | 0.90 / 0.93 | 0.07 |

| Aegon Shariah | HSBC Islamic Global Equity Index | 0.50 / 0.50 | 0.02 |

| NATS Global Equity | 65% BlackRock DC Aquila MSCI World Index (hedged), 20% BlackRock DC Aquila MSCI World Index 15% BlackRock DC Aquila Emerging Markets Equity Index |

0.21 / 0.22 | -0.02 |

| NATS Corporate Bond | BlackRock DC Aquila Corporate Bond All Stocks | 0.15 / 0.16 | 0.03 |

| NATS Index-Linked Gilts | BlackRock DC Aquila Over 5 Year Index Linked Gilt | 0.15 / 0.16 | 0.05 |

| NATS Fixed Interest Gilts | BlackRock DC Aquila Over 15 Year Fixed Interest Gilt | 0.15 / 0.16 | 0.00 |

| NATS DC Cash | BlackRock DC Cash | 0.15 / 0.18 | 0.02 |

Source: Aegon as at 31 December 2021

a) Due to the way in which transaction costs are calculated, they can be negative or positive in nature; a negative figure is effectively a gain from trading activity, whilst a positive figure is effectively a cost from trading activity

The transactions charges that apply during the decumulation phase of the default strategy will be reflective of the composite funds during that period. Details of how this has been allowed for in the impact of charges illustrations can be found below.

Default: Income Drawdown Lifestyle

The following table details the weighted TER for each year in the 10 years to retirement based on the allocation of the underlying components which make up the default strategy as detailed in the graph above.

| Components of default strategy | % Allocation (years to retirement) | ||||||||||

| >10 | 9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 | 1 | 0 | |

| NATS Higher Growth | 100 | 93 | 86 | 79 | 72 | 65 | 58 | 51 | 44 | 37 | 30 |

| NATS Cautious | 0 | 7 | 14 | 21 | 28 | 32.5 | 37 | 41.5 | 45 | 45 | 45 |

| NATS DC Cash | 0 | 0 | 0 | 0 | 0 | 2.5 | 5 | 7.5 | 11 | 18 | 25 |

| Total % Allocation | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Weighted TER (% p.a.) | 0.60 | 0.59 | 0.59 | 0.58 | 0.58 | 0.56 | 0.55 | 0.54 | 0.52 | 0.49 | 0.46 |

Illustration of the compounding effect of transaction costs and charges on members’ benefits.

Using the charges and transaction cost data in accordance with regulation 23(1)(ca) of the Administration Regulations, as inserted by the 2018 Regulations, the Trustees’ administrators, Aegon, have prepared an illustration detailing the impact of the costs and charges typically paid by a member of the Scheme on their retirement savings pot. The statutory guidance provided has been considered when providing these examples.

The below illustration has taken into account the following elements:

- Savings pot size;

- Contributions;

- Real terms investment return gross of costs and charges;

- Adjustment for the effect of costs and charges; and

- Time.

To make this representative of the membership, Aegon have based this on the youngest member with an age of 20 using a starting pot size of £43,000 based on the median fund size of the Scheme and a £870 monthly contribution which is assumed to increase by 3.5% per annum in line with assumed rises in pensionable salary.

Projected Pension Pot (in today’s money)

This is not a personal illustration but is based on the assumptions detailed later on in this document. The purpose of the illustration is to show how fund-related costs and charges can affect the overall value of the funds you invest in over time.

| Impact of transaction costs and charges on fund values (£) | ||||||

| Years | Default Income Drawdown Lifestyle | NATS Index Linked Gilts | Aegon Ethical | |||

| Before charges

£ |

After all charges

£ |

Before charges

£ |

After all charges

£ |

Before charges

£ |

After all charges

£ |

|

| 1 | 53,978 | 53,615 | 52,470 | 52,380 | 54,609 | 53,980 |

| 3 | 76,827 | 75,482 | 71,354 | 71,035 | 79,211 | 76,837 |

| 5 | 100,910 | 98,221 | 90,179 | 89,569 | 105,752 | 100,929 |

| 10 | 166,851 | 159,077 | 137,118 | 135,531 | 181,402 | 166,906 |

| 15 | 241,674 | 226,036 | 184,129 | 181,233 | 272,045 | 241,787 |

| 20 | 326,312 | 299,600 | 231,520 | 227,013 | 380,082 | 326,507 |

| 25 | 421,785 | 380,313 | 279,595 | 273,200 | 508,273 | 422,091 |

| 30 | 529,208 | 468,761 | 328,660 | 320,117 | 659,785 | 529,660 |

| 35 | 649,802 | 565,574 | 379,018 | 368,082 | 838,248 | 650,439 |

| 40 | 772,583 | 661,432 | 430,978 | 417,416 | 1,047,820 | 785,767 |

| 45 | 874,344 | 739,574 | 484,853 | 468,436 | 1,293,269 | 937,109 |

Source: Aegon

‘Years’ means the number of years of membership of the Scheme assuming the member joins the Scheme on a salary of £58,000.

The ‘Before Charges’ column shows each fund value without any transaction costs, charges or expenses being applied to the fund’s holdings.

The ‘After all charges’ column shows the fund’s holdings after transaction costs, charges and expenses have been deducted. Transaction costs are based on the average of the actual transaction costs for the period 1 January 2018 to 31 December 2021.

About this illustration

- The youngest age is 20 and retirement age is 65.

- Current salary is £58,000 and will increase each year by 3.5%.

- Future contributions paid will be 18% of salary (£870 each month increasing by 3.5% each year in line with assumed salary increases).

- The existing fund value is £43,000 which is based on the median value of the total fund holdings within the Scheme, from the lowest to the highest value and selecting the value in the middle.

- We have shown the default investment option that the majority of members invest in.

- We have also shown the NATS Index Linked Gilts and Aegon Ethical funds to show the asset classes with the lowest and highest charges respectively.

Investment Growth Assumption

The value of the investments is assumed to grow at a rate appropriate to the fund allowing for inflation of 2.0% every year. This is an illustrative growth rate only. The actual investment growth achieved may be more or less than this and may vary depending on the fund(s) you are invested in.

The assumed growth rate used for each fund is shown in the table below.

| Growth* Assumptions | ||

| Default Income Drawdown Lifestyle**

(% p.a.) |

NATS Index Linked Gilts

(% p.a.) |

Aegon Ethical (% p.a.) |

| -1.90 to 1.36 | -1.80 | 2.74 |

* Growth is the assumed growth rate for the fund after taking into account assumed price inflation of 2% per annum.

** As the Lifestyle investment option consists of multiple investment funds we have shown the range of growth and fund costs and charges.

This rate is based on Aegon’s view of potential long-term returns of the main asset classes (equities, property, corporate bonds, government bonds and cash) and will vary depending on the fund(s). The growth rates for mixed assets funds are derived from the assets class growth rates based on the investment objectives and long-term asset allocation of the funds.

If the growth rate Aegon have used is:

- the same as the rate of inflation, this reduces the growth rate, after making an allowance for inflation, to 0%.

- less than the rate of inflation, this produces a negative growth rate after making an allowance for inflation.

4. Net Return on Investments

From 1 October 2021 trustees of all relevant pension schemes are required under the Occupational Pension Schemes (Administration, Investment, Charges and Governance) (Amendment) Regulations 2021 to calculate and state the return on investments from their default and self-select funds, net of transaction costs and charges, for all the funds members were invested in over the year to 31 December 2021.

The table below shows the performance, net of all charges and transaction costs, of the current default investment strategy targeting income drawdown for members aged 25, 45 and 55 years. This has been prepared in line with statutory guidance. This would also be the same performance for members invested in the growth phase of the Lifestyle strategies targeting Annuity and Cash at retirement.

| Income Drawdown Lifestyle | Annualised net returns to 31 December 2021 (%) | ||

| Age of member | 1 year | 5 years | 10 years |

| 25 | 10.7 | 7.3 | 6.8 |

| 45 | 10.7 | 7.3 | 6.8 |

| 55 | 10.7 | 7.3 | 6.8 |

Source: Aegon and Mercer

Performance shown net of all charges and transaction costs. Performance has been calculated based on a fixed weighted average of underlying fund performance in the lifestyle, with the weightings as at the ages shown.

As the growth phase is equal between the lifestyles, the expected return are assumed to be equal as well.

Members are invested in the growth phase of the lifestyle until 10 years from retirement. Therefore, the return is expected to be consistent over the ages shown.

The table below show the performance, net of all charges and transaction costs, of the self-select range of funds available to members to invest in. This has been prepared in line with statutory guidance.

| Self-select fund | Annualised net returns to 31 December 2021 (%) | ||

| 1 year | 5 years | 10 years | |

| NATS Higher Growth | 10.7 | 7.3 | 6.8 |

| NATS Diversified Growth | 5.0 | 4.2 | 3.9 |

| NATS Cautious | -0.4 | 3.8 | 4.6 |

| NATS Pre-Retirement | -4.3 | 2.5 | 4.0 |

| Aegon Ethical | 16.1 | 7.1 | 10.2 |

| Aegon Shariah | 26.5 | 18.3 | 16.3 |

| NATS Global Equity | 19.6 | 12.4 | (a) |

| NATS Corporate Bond | -3.2 | 3.3 | (a) |

| NATS Index Linked Gilts | 4.1 | 4.9 | (a) |

| NATS Fixed Interest Gilts | -7.4 | 4.0 | (a) |

| NATS DC Cash | -0.1 | 0.3 | 0.3 |

Source: Aegon

Performance shown net of all charges and transaction costs. Performance of standalone self-select options is independent of age, therefore performance is shown in a different format to the lifestyle performance on the previous page.

(a) Longer term performance is not available for these funds

5. Value for members

The Trustees are committed to ensuring that members receive good value from the Scheme. There is no legal definition of “good value”, so the process of determining good value is a subjective one. “Value” is not a straightforward concept to quantify and can be open to broad interpretation.

The Trustees recognise that good value does not necessarily mean the cheapest fund and, in conjunction with their professional advisors, they undertook a full formal value for money assessment for the year to 31 December 2021 which covered the following aspects:

- Member borne investment charges for the default and self-select options against comparable alternatives;

- Net of fees investment performance;

- Investment fund range and ratings;

- Other services paid for by members including administration and communication; and

- Wider key areas of the Scheme including governance oversight and features paid for by the Company.

The Trustees noted a number of challenges in assessing transaction costs:

- No industry-wide benchmarks for transaction costs exist,

- The methodology leads to some curious results, most notably “negative” transaction costs,

- Transaction costs are already taken into account when investment returns are reported, so any assessment must also be mindful of the return side of the costs.

The Trustees note the costs continue to be in line with our expectations and are at a reasonable level. However, the Trustees will continue to monitor transaction costs for value and monitor developments in assessing such costs.

The outcome of the formal Value for Members’ assessment to December 2021 concluded that the Scheme’s overall benefits represent good value for money in comparison to the costs payable by members. The reasons underpinning this conclusion include:

- The funds used by the Scheme are generally highly rated by our investment advisors as having good prospects of achieving their objectives.

- Other services paid for by members, including administration and communication services, were deemed good value.

- The Scheme was deemed to be well governed which helps the chances of members achieving good member outcomes in retirement.

- The members also receive value from features paid by the Company, including the cost of maintaining a Trustee board with duties to act in the best interests of beneficiaries. These costs include the board’s advisory costs.

6. Trustee Knowledge and Understanding

The Pensions Act 2004 requires individual trustees to have appropriate knowledge and understanding of the law relating to pensions and trusts and the investment of the assets. The degree of knowledge and understanding required is that appropriate for the purposes of enabling the Trustees to exercise the function in question.

There is an induction process for new Trustees. All new Trustees are sent a link to Scheme documents including the latest Trust Deed & Rules (which are stored on an online repository). The Member-Nominated Trustee (“MNT”) nomination process includes checks on ‘fitness to act’ as a Trustee. The Nomination form (in the communication to members contains a declaration of fitness checklist for the candidate to confirm and sign). The successful candidate is expected to complete the trustee toolkit within 3 months of acceptance of the role.

The Trustee board is comprised of 3 member-nominated trustees and 4 compan- appointed trustees, one of which is an Independent Trustee. The Independent Trustee is Chair of the Scheme.

The independent chair also chairs a number of other similar pension schemes. The chair has years of pensions experience including negotiating on pensions at Board and Remuneration Committee level with a number of PLCs. He keeps up to date through attending the annual conference at the Pensions Management Institute and the Pension and Lifetime Savings Association. He keeps his knowledge refreshed holding the certificates in Defined Contribution and Defined Benefits trusteeship, the certificate in Defined Contribution Governance awarded by the Pensions Management Institute. The range and depth of experience helps set the pace and agenda.

Leadership is an increasingly important area for all trustee boards. The Trustees recognise that whilst the chair sets the overall pace and agenda, individual trustees take the lead and ownership of different elements of the work including investment, accounting, communications, trustee selection, trustee discretions, supplier management, meetings with Board, management and unions. The team value diversity and seek to maintain that diversity as an element in trustee appointment. There are no silent voices with individual trustees providing leadership in different ways. The diversity supports informed debate and high quality decision making.

The Trustees are also required to explain how their combined knowledge and understanding, together with the advice which is available to them, enables them properly to exercise their functions as trustees of the scheme. It is recognised that this has been an unprecedented year where new processes have had to be adopted to enable the Trustees to be able to effectively manage the Scheme in the virtual environment as well as maintain their own levels of knowledge and understanding. Examples of the arrangements in place under the Scheme to ensure this are as follows:

- All Trustees have completed the mandatory modules of the Pension Regulator’s online Trustee Toolkit. This is required for all trustees. The Trustees are aware of changes and additions to the Trustee Toolkit modules and update their knowledge as these occur.

- The Trustees receive regular training and are encouraged to identify gaps in knowledge.

The Trustees had two dedicated training sessions in 2021, a DC Market Trends training on 23 September 2021 and an ESG training session on 15 October 2021.

- The Trustees receive regular investment training and receive presentations from the managers and Aegon. An Aegon proposition update is being planned for Q1 2022.

- In addition, the Trustees’ Pension Consultant provided a current topics paper on a quarterly basis, covering such items as industry trends and important legislative requirements.

- The Trustees maintain a training register to keep a log of all training undertaken. The log is updated regularly and assessed to identify knowledge gaps. A Trustee Effectiveness survey is planned for the end of 2022.

- The Trustees take regular investment advice from their Investment Consultant on matters relating to the Scheme’s investments.

- The Trustees’ agendas have input from professional advisors who do so with a view to ensuring compliance and best practice.

- The Trustees also receive advice from professional advisors and the relevant skills and experience of those advisors is a key criterion when evaluating advisor performance or selecting new advisors.

A new Trustee was welcomed to the Board in February 2021 and as well as engagement with the Trustee Toolkit they also attended a bespoke training session with the professional adviser as an introduction to pensions and the NATS DC Pension Scheme.

The Trustees are conversant with, and have demonstrated a working knowledge of, the Scheme, documents such as the Trust Deed and Rules and the powers that they provide to them, Statement of Investment Principles and documents setting out the Trustees’ compliance. They do this through their maintenance of a Document and Policy Schedule, which is a standing item at each meeting where key policies and documents are reviewed in turn and updated if appropriate. The table below sets out the Review Schedule to the end of December 2021.

| Policies, Procedures and Scheme Documentation Review Schedule | ||||

| Frequency | Document Type | Description | Date last reviewed | Date of next review |

| Ongoing as required | Scheme document | Scheme Deed & Rules | December 2016 | Ongoing |

| EGLT Deed & Rules | December 2016 | Ongoing | ||

| Booklet & Contribution Schedules | October 2016 | Ongoing | ||

| Expression of wish form | March 2015 | Ongoing | ||

| Payment Schedule | June 2019 | May 2022 | ||

| Register | Trustee register of interests | June 2016 | Ongoing | |

| Annually | Scheme document | Value for money assessment | May 2021 | May 2022 |

| Statement of Investment Principles | November 2021 | November 2022 | ||

| CMA IC Objectives | November 2021 | September 2022 | ||

| DC Code assessment | September 2020 | Q2 2022 (when new single code released) | ||

| Register | Risk register | October 2021 | October 2022 | |

| Statement | Chairman’s Statement | May 2021 | May 2022 | |

| Every three years | Trustee policy & discretions | Transfers in | August 2020 | August 2023 |

| Retirement Flexibilities | December 2019 | September 2022 | ||

| Death benefit policy and procedure | June 2020 | June 2023 | ||

| Trustee policy | Member Nominated Trustees | November 2021 | November 2024 | |

| Active Transfers Out | November 2021 | November 2024 | ||

| UFPLS flexibility | August 2020 | August 2023 | ||

| Every five years | Trustee policy | Bribery | August 2020 | August 2025 |

| Conflicts of interest | August 2020 | August 2025 | ||

During the year the Trustees reviewed and updated their Risk Register to include the additional risks facing both members and the Scheme, considering the mitigations currently in place and liaising with their advisors, the Company and third party providers to ensure that processes are in place for risks that were identified.

The Trustees reviewed their Active Transfers Out policy, considering the current Rules in line with industry trends, the options available to members and the support provided.

The Trustees undertook a number of additional activities that involved giving detailed consideration to pensions and trust law, the Scheme’s governing documents and investment principles. This allowed them to exercise their knowledge and understanding and to further strengthen their capabilities. These included:

- Seeking advice from their professional advisors on a number of pension matters

- Reviewing the investment strategy and whether this was in line with the Statement of Investment Principles.

- Considering their strategic investment objectives and reviewing their investment consultant against these.

The Trustees also review and assess, on an ongoing basis, whether the systems, processes and controls across key governance functions are consistent with those set out in the Pensions Regulator’s Code of Practice 13. They look at all aspects of administration and risk in the Scheme including reviewing the DC Code in practice in detail. In addition, the Trustees consider their annual training plan on a quarterly basis.

Based on these actions, taken individually and as a Trustee body, and the professional advice available to them, the Trustees consider that they have sufficient skills and resources to properly exercise their function as a Trustee.

Chair’s declaration

This statement has been prepared in accordance with Regulation 23 of the Occupational Pension Schemes (Scheme Administration) Regulations 1996 as amended by the Occupational Pension Schemes (Charges and Governance) 2015 (together ‘the Regulations’) and I confirm that the above statement has been produced by the Trustees of the NATS Defined Contribution Scheme.

Signed:

Signed by David Grimes, the Chair of the NATS Defined Contribution Pension Scheme, on 21 June 2022.

APPENDIX 1 – Statement of Investment Principles dated August 2020

1. Introduction

The purpose of this Statement of Investment Principles (the “Statement”) is to record the investment principles of the Trustees of the NATS Defined Contribution (“DC”) Pension Scheme (the “Scheme”) in accordance with the requirements of the Pensions Act 1995, as amended by the Pensions Act 2004 and Occupational Pension Scheme (Investment) Regulations 2005, and the Occupational Pension Schemes (Charges and Governance) Regulations 2015.

The Scheme is a wholly-insured scheme as defined in Regulation 8 (2) of The Occupational Pension Schemes (Investment) Regulations 2005. As a result, the asset held by the Trustees is the policy of insurance issued by the Bundled DC Provider (the “Provider”). This Statement sets out the required principles governing decisions about the investment options available under this Policy for the Scheme and the reasons why it is a wholly-insured scheme.

Before preparing this Statement of Investment Principles, the Trustees have consulted with the Employer, (NATS Ltd), and obtained and considered written professional advice from Mercer Limited, the Scheme’s investment consultants, regarding the Scheme’s investment strategy.

2. The Trustees

The Scheme’s assets are held in Trust by the Trustees. The Trustees are responsible for the investment of the Scheme’s assets and their investment powers are set out in the Scheme’s Trust Deed. The Trustees are responsible for some decisions and delegate the balance. When determining which decisions to delegate, the Trustees have taken into account whether they have the appropriate training and are able to secure the necessary expert advice in order to take an informed decision. Further, the Trustees’ ability to effectively execute the decision is also considered.

3. Reasons for the wholly insured approach

A wholly-insured scheme is where all the assets (mainly excluding cash held in the Trustees’ bank account) are held in one or more qualifying insurance policies. The Trustees consider that a wholly-insured approach is an appropriate arrangement. This route provides lower operational costs than alternative options and a reasonable range of services including a choice of investment options.

The Trustees will review the continued appropriateness of the wholly-insured approach at least triennially or more frequently if required.

4. Responsible Investment and Corporate Governance (Voting and Engagement)

The Trustees believe that environmental, social, and corporate governance (“ESG”) factors may have a material impact on investment risk and return outcomes, and that good stewardship can create and preserve value for companies and markets as a whole. The Trustees also recognise that long-term sustainability issues, particularly climate change, present risks and opportunities that increasingly may require explicit consideration.

The Trustees have given appointed investment managers full discretion in evaluating ESG factors, including climate change considerations, and exercising voting rights and stewardship obligations attached to the investments, in accordance with their own corporate governance policies and current best practice, including the UK Corporate Governance Code and UK Stewardship Code. Manager’s engagement polices are expected to include all relevant matters including performance, strategy, capital structure, management of actual or potential conflicts of interest, risks, social and environmental impact and corporate governance.

The Trustee considers how ESG, climate change and stewardship is integrated within investment processes in appointing new investment managers and monitoring existing investment managers. This is done using ESG ratings on funds provided by the Scheme’s investment consultant. These ratings represent the extent to which managers integrate ESG factors and active ownership into their core processes. The ESG ratings for the existing investment managers are provided on a quarterly basis.

The Trustees have not set any investment restrictions on the appointed investment managers in relation to particular products or activities, but may consider this in future. The Trustees have agreed to monitor developments in this area within the confines of the funds made available to the Scheme by the Provider.

5. Investment Objectives and Policies

5.1 Investment objectives

The Trustees recognise that members have differing investment needs and that these may change during the course of members’ working lives. The Trustees also recognise that members have different attitudes to risk. The Trustees believe that members should make their own investment decisions based on their individual circumstances.

The following encapsulates the Trustees’ objectives:

- To make available a range of investment funds and range of lifestyle strategies that should enable members to tailor their own investment strategy to meet their own individual needs.

- Offer funds which facilitate diversification and long term capital growth (in excess of inflation).

- Offer funds that enable members to reduce risk in their investments as they approach retirement.

- Offer funds which mitigate the impact of sudden and sustained reductions in market values or rises in the cost of purchasing annuities.

- To structure the range of funds, provide a suitable number of funds, and present this range in a manner which may make it easier for members to make investment decisions.

- To provide a default investment lifestyle strategy for members until they make their own investment decisions.

The Trustees are responsible for deciding the range of funds and lifestyle strategies to offer to members. In determining what types of funds and lifestyle strategies are offered, the Trustees have taken investment advice regarding the suitability of investment vehicles considering factors such as: the asset class (or classes), the level of diversification and the nature of the member and investment objectives.

However, the Trustees have no influence over the investment aims of each underlying fund used or how the investment managers choose the underlying investments within each fund, as the assets are pooled with many other investors to obtain economies of scale. Nevertheless, notwithstanding how the assets of each fund are managed, the Trustees regularly obtain professional advice to monitor and review the suitability of the funds provided and from time to time may change the managers or investment options.

5.2 Investment Policies

The Trustees have made available a range of individual self-select fund options for investment in addition to the default investment option. A range of asset classes has been made available, including: equities, diversified growth funds, money market investments, gilts, index-linked gilts, corporate bonds and pre-retirement funds. It is the Trustees’ policy to offer both active and passive management options to members where appropriate, depending on asset class. All funds are daily-dealt pooled investment arrangements, with assets mainly invested on regulated markets.

All of the funds allocated to within the default investment option are also available as self-select options. More details specifically related to the default investment option are provided in a separate section in this Statement.

The Trustees’ policy in relation to the balance between the different kinds of investment is set out in the ‘Investment Strategy’ section of this Statement (section 6).

The Trustees have considered risks from a number of perspectives. The list below is not exhaustive but covers the main risks that the Trustees consider and how they are managed.

| Risk | How it is managed | How it is measured |

| Inflation Risk

The real value (i.e. post inflation) value of members’ accounts decreases. |

The Trustees provide members with a range of funds, across various asset classes, with the majority expected to keep pace with inflation (with the exception of the money market and fixed interest bond funds).Members are able to set their own investment allocations, in line with their risk tolerances. | Considering the real returns (i.e. return above inflation) of the funds, with positive values indicating returns that have kept pace with inflation. |

| Pension Conversion Risk

Member’s investments do not match how they would like to use their pots in retirement. |

The Trustees make available three lifestyling strategies for DC members, each targeting either cash, drawdown or annuity.

Lifestyle strategies automatically switch member assets as they approach retirement into investments that are expected to be less volatile relative to how they wish to access their pension savings. These lifestyling strategies increase the proportion of assets that more closely match the chosen retirement destination as members approach retirement. This aims to reduce the risk of a substantial fall in the purchasing power of their accumulated savings near retirement. |

Considering the returns of the funds used within the switching phase of the lifestyle strategy both in absolute terms as well as relative to inflation, cash or annuity prices (depending on their selected retirement destination). |

| Market Risk

The value of securities, including equities and interest bearing assets, can go down as well as up. |

The Trustees provide members with a range of funds, across various asset classes. Members are able to set their own investment strategy in line with their risk tolerances.For the multi-asset funds which are targeting non-market benchmarks, this is delegated to investment managers. | Monitoring the performance of investment funds on a quarterly basis. |

| Counterparty Risk

A counterparty, either an underlying holding or pooled arrangement, cannot meet its obligation. |

Delegated to investment managers.Members are able to set their own investment allocations, in line with their risk tolerances. | Monitoring the performance of investment funds on a quarterly basis. |

| Currency Risk

The value of an investment in the member’s base currency may change as a result of fluctuating foreign exchange rates. |

The Trustees provide diversified investment options that invest in local as well as overseas markets and currencies.Delegated to investment managers.

Members are able to set their own investment allocations, in line with their risk tolerances. |

Monitoring the performance of investment funds on a quarterly basis.Consideration to the movements in foreign currencies relative to pound sterling |

| Liquidity Risk

Assets may not be readily marketable when required. |

The Trustees access daily dealt and daily priced pooled funds through the Provider. | The pricing and dealing terms of the funds underlying the unit-linked insurance contract |

| Valuation Risk

The value of an illiquid asset is based on a valuer’s opinion, realised value upon sale may differ from this valuation. |

Some multi-asset managers may hold illiquid assets. In such cases, the management of valuation risk is delegated to the external investment manager.

The majority of investment managers invest solely in liquid quoted assets. |

The Trustees monitor performance of funds on a quarterly basis, and where relevant delegates the monitoring of valuation risk to the investment consultant. |

| Environmental, Social and Governance Risk

ESG factors can have a significant effect on the performance of the investments held by the Scheme e.g. extreme weather events, poor governance. |

Delegated to investment managers.

The Trustees’ policy on ESG risks is set out in Section 4 of this Statement. |

Section 4 of this Statement also covers how the Trustees monitor the extent to which managers integrate ESG factors and active ownership into their core processes. |

| Manager Skill / Alpha Risk

Returns from active investment management may not meet expectations, leading to lower than expected returns to members. |

The Trustees make available a number of actively managed funds to DC members where they deem appropriate; for example, multi-asset funds.

The actively managed funds made available are highly rated by their investment consultant, based on forward-looking expectations of meeting objectives. |

The Trustees consider the ratings of investment strategies from their investment consultant during the selection process.

Trustees monitor performance and rating of funds on an ongoing basis relative to the fund’s benchmark and stated targets/objective |

The Trustees recognise that all forms of investment carry some degree of risk. The Trustees have considered these risks when setting the Investment Strategy and ultimately the choice of funds made available to members as detailed in the following section.

The risks identified in the above table are considered by the Trustees to be ‘financially material considerations’. The Trustees believe the appropriate time horizon for which to assess these considerations within should be viewed at a member level. This will be dependent on the member’s age and their selected retirement age. It is for this reason that a number of lifestyle options have been made available to members.

Member views, when expressed, are considered in relation to financial and non-financial matters. The Trustees have made available separate socially responsible and Shariah Law compliant funds as part of the non-core fund range as options to members who wish to invest ethically or sustainably or according to particular religious principles.

The Trustees’ policy in relation to the expected return on investments is set out in Section 8 of this Statement.

In selecting assets, the Trustees consider the liquidity of the investments in the context of the likely needs of members. All assets are daily dealing and therefore should be realisable based on member demand.

6. Investment Strategy

6.1 Range of Funds and lifestyle strategies

The Trustees believe, having taken expert advice, that it is appropriate to offer a range of investment funds and lifestyle strategies to allow members to tailor their own investment strategy.

- The Trustees have decided to adopt three lifestyle strategies to reflect the different ways members can take benefits from DC pension savings at retirement (cash, income drawdown and annuity). If members can answer two key questions: when they intend retiring and how they want to take their benefits in retirement, these lifestyle strategies help less sophisticated members manage the investment strategy over the course of their working lifetimes.

- The Trustees have decided to adopt a core range of funds, defined by their risk/return characteristics to facilitate members choosing fund options which are broadly appropriate to their needs.

- The Trustees have also decided to offer a selection of non-core specialist funds for members wishing to more closely tailor their fund choices to their personal circumstances.

- The Trustees have ensured, in accordance with recent legislation, that investments in the default lifestyle investment option will have a Total Expense Ratio (TER) not exceeding 0.75% p.a. The members pay a proportion of the applicable investment management charges for the funds through an annual ad valorem fee. The Company/Trustees pay the remainder through a fixed fee per member.

The Trustees have decided to offer the following types of funds and lifestyle strategies to members:

Lifestyle options

- Annuity Lifestyle – lifestyle option progressively and automatically switches members from higher risk/higher returning funds to lower risk/lower returning funds as the member approaches their selected retirement date, and is designed to be suitable for members wishing to purchase an annuity at retirement.

- Cash Lifestyle – lifestyle option progressively and automatically switches members from higher risk/higher returning funds to lower risk/lower returning funds as the member approaches their selected retirement date, and is designed to be suitable for members wishing to take a cash lump sum at retirement.

- Drawdown Lifestyle – lifestyle option progressively and automatically switches members from higher risk/higher returning funds to lower risk/lower returning funds as the member approaches their selected retirement date, and is designed to be suitable for members looking for the flexibility to drawdown their pension pot in retirement. The reduction in risk as the member approaches retirement is less than the cash and annuity lifestyles.

Core Funds

- Higher Growth – diversified across asset classes, but with a bias towards equities

- Cautious – diversified across asset classes, but with a bias towards bonds

- Pre-Retirement – investing in cash and longer dated bonds

Non-Core Funds

- Diversified Growth – diversified across asset classes

- Socially Responsible – invests in equities which meet a selection of socially responsible criteria

- Shariah Law – invests in equities which are deemed to be compliant with Shariah Law

- Global Equity – invests solely in passive global equities which are expected to provide the potential for strong returns over the longer-term, but with a higher level of volatility risk

- Corporate Bond – invests in investment grade corporate bonds denominated in sterling.

- Index-Linked Gilts – invests in index-linked UK government bonds with maturities of five years or longer.

- Fixed Interest Gilts – invests in fixed-interest UK government bonds with maturities of 15 years or longer.

- Cash – invests in Sterling denominated cash, deposits and money-market instruments.

Day-to-day management of the assets is at the discretion of the managers of the pooled funds.

The Trustees recognise that investment-related aspects of the conversion risk can be mitigated by the availability of suitable funds.

Members should not make investment decisions on the basis of this document.

6.2 Default Lifestyle Strategy

The Trustees recognise that, while the lifestyle strategy range and core fund range should help members choose funds, not all members wish to make an active choice that is tailored to their individual circumstances. Therefore, the Trustees have provided a default investment option. The Trustees have decided that this default should take the form of the “drawdown lifestyle” option which is also available for members to choose deliberately.

The aims of the default investment option

The Trustees believe that:

The default lifestyle strategy’s growth phase structure, which invests in equities and other growth-seeking assets, will provide growth with lower volatility than equities and some protection against inflation erosion.

As a member’s pot grows, investment risk will have a greater impact on member outcomes. Therefore, the Trustees believe that the default lifestyle strategy that seeks to reduce investment risk as the member approaches retirement is appropriate.The default lifestyle strategy progressively and automatically switches members from higher risk/higher returning funds to lower risk/lower returning funds as the member approaches their selected retirement date, and is designed to be suitable for members looking for the flexibility to drawdown their pension pot in retirement.

The Trustees, having taken appropriate advice, have decided that switching should take place over a 10 year period.

Based on their understanding of the Scheme’s membership, an investment strategy that targets income drawdown and a tax-free cash lump sum (up to 25% of a members’ pot) at retirement is likely to meet a typical member’s requirements for income in retirement. This does not mean that members have to take their benefits in this format at retirement – it merely determines the default investment strategy that will be in place pre-retirement. Members who intend to take their retirement benefits through other formats have the option of switching to an alternative lifestyle strategy prior to retirement or even choosing their own investment strategy. The Trustees believe that a default strategy that maintains a well-diversified investment portfolio in the run up to retirement provides the best compromise against potential risks and ensures individuals are well equipped to navigate their options.

Policies in relation to the default investment option

A range of asset classes are included within the default investment option (within the blended funds used), including: developed market equities, emerging market equities, money market investments, diversified growth funds and pre-retirement funds. All funds are daily-dealt pooled investment arrangements, with assets mainly invested on regulated markets. It is the Trustee’s policy to utilise both active and passive management within the default investment option, depending on the asset class.

The default lifestyle strategy manages investment and other risks through a diversified strategic asset allocation consisting of traditional and alternative assets. Risk is not considered in isolation, but in conjunction with expected investment returns and outcomes for members. Any investment in derivative instruments contributes to risk reduction, or efficient portfolio management. The expected return targeted by each fund

is in the default lifestyle strategy is shown in the “Investment Policy Implementation Document”.

The default investment option allocates to a diversified strategic asset allocation consisting of traditional and alternative assets. The asset allocation is consistent with the expected amount or risk that is appropriate given the age of a member and their selected retirement age.

The Trustees have considered risks from a number of perspectives. The list below is not exhaustive but covers the main risks that the Trustees consider and how they are managed.

| Risk | How it is managed | How it is measured |

| Inflation Risk

The real value (i.e. post inflation) value of members’ accounts decreases. |

During the growth phase of the default investment option the Trustees invest in a diversified range of assets which are likely to grow in real terms.

The default investment option invests in a diversified range of assets which are considered likely to grow in excess of inflation. |

Considering the real returns (i.e. return above inflation) of the funds, with positive values indicating returns that have kept pace with inflation. |

| Pension Conversion Risk

Member’s investments do not match how they would like to use their pots in retirement. |

The default investment option is a lifestyling strategy which targets flexible access income drawdown as a retirement destination.

The Trustees believe that a strategy targeting drawdown minimises the overall pension conversion risk for the relevant members accessing pots in a different manner (annuity or drawdown). |

Considering the returns of the funds used within the switching phase of the lifestyle strategy both in absolute terms as well as relative to inflation (the retirement destination).

As part of the triennial default strategy review, the Trustees ensure the default destination remains appropriate. |

| Market Risk

The value of securities, including equities and interest bearing assets, can go down as well as up. |

The default investment strategy is set with the intention of diversifying this risk to reach a level of risk deemed appropriate for the relevant members by the Trustees.

For the diversified growth funds which are targeting non-market benchmarks this is delegated to investment managers. |

Monitoring the performance of the default investment strategy on a quarterly basis. |

| Counterparty Risk

A counterparty, either an underlying holding or pooled arrangement, cannot meet its obligation. |

In line with the main Scheme.

Investment strategy is set with the intention of diversifying this risk to reach a level of risk deemed appropriate for the relevant members by the Trustees. |

Monitoring the performance of the default investment option on a quarterly basis. |

| Currency Risk

The value of an investment in the member’s base currency may change as a result of fluctuating foreign exchange rates. |

A large proportion of equity allocation of the default investment option is currency hedged. Within the diversified growth funds the currency risk management is delegated to investment managers.

Investment strategy is set with the intention of diversifying this risk to reach a level of risk deemed appropriate for the relevant members by the Trustees. |

The Trustees reviews the level of currency hedging used in the equity portfolio as part of the triennial default strategy review.

Monitoring the performance of investment funds on a quarterly basis. Consideration to the movements in foreign currencies relative to pound sterling. |

| Liquidity Risk

Assets may not be readily marketable when required. |

In line with the main Scheme. | In line with the main Scheme. |

| Valuation Risk

The value of an illiquid asset is based on a valuer’s opinion, realised value upon sale may differ from this valuation. |

Some multi-asset managers may hold illiquid assets. In such cases, the management of valuation risk is delegated to the external investment manager.

The majority of underlying holdings within the default investment strategy are invested in liquid quoted assets. |

In line with the main Scheme. |

| Environmental, Social and Governance Risk

ESG factors can have a significant effect on the performance of the investments held by the Scheme e.g. extreme weather events, poor governance. |

In line with the Scheme.

The Trustees’ policy on ESG risks is set out in Section 4 of this Statement. |

In line with the main Scheme. |

| Manager Skill / Alpha Risk

Returns from active investment management may not meet expectations, leading to lower than expected returns to members. |

In line with the main Scheme.

The default investment strategy is set with the intention of diversifying this risk to reach a level of risk deemed appropriate for the relevant members by the Trustees. |

In line with the main Scheme. |

The risks identified in the above table are considered by the Trustees to be ‘financially material considerations’. The Trustees believe the appropriate time horizon for which to assess these considerations within should be viewed at a member level. This will be dependent on the member’s age and their selected retirement age. It is for this reason that a number of lifestyle options have been made available to members.

Member views, when expressed, are considered in relation to financial and non-financial matters.

In selecting assets, the Trustees consider the liquidity of the investments in the context of the likely needs of members. All assets are daily dealing and therefore should be realisable based on member demand.

Suitability of the default investment option

Taking into account the demographics of the Scheme’s membership and the Trustees’ views of how the membership will behave at retirement, the Trustees believe that the default strategy outlined in this document is appropriate. The rationale underpinning this belief is as follows:

- The Trustees believe that most members save into a pension scheme to achieve an income in retirement. However, the Trustee also believes that members will utilise the new flexibility available to them at retirement. The targeting income drawdown at retirement is aligned with both these beliefs. This does not mean that members have to take their benefits in this format at retirement – it merely determines the investment strategy that will be in place pre-retirement.

- In addition, the Trustees believe that a default strategy that maintains a well-diversified investment portfolio in the run up to retirement provides the best compromise against potential risks and ensures individuals are well equipped to navigate their options.

- Experience shows that almost all members withdraw tax-free cash at retirement. The use of the Cash fund within the default option addresses that requirement.

- Members seeking an adequate income in retirement will likely need to achieve real investment returns for most of their period as pension savers. The retention of some exposure to growth seeking assets throughout the glidepath phase addresses that requirement.

The Trustees are aware that no default fund or lifestyle option can be appropriate for all members because of their varying needs and attitudes to risk. The Trustees would therefore encourage members to make their own investment decisions, particularly with respect to the retirement outcome they would like to target. Alternative lifestyle strategies targeting a cash lump sum and annuity purchase, or 100% cash are also available.

The Trustees will review the appropriateness of the default investment option periodically, or after significant changes to the Scheme’s demographic, taking into account the demographics of the Scheme’s membership and the Trustees’ views of how the membership will behave at retirement. The detail regarding the funds and lifestyle strategies, including the default, are detailed in an Investment Policy Implementation Document.

7. Day-to-Day Management of the Assets

The Trustees delegate the day to day management of the assets to the Provider and the underlying investment managers. The Trustees have taken steps to satisfy themselves that the Provider and underlying fund managers have the appropriate knowledge and experience for managing the Scheme’s investments and they are carrying out their work competently.

The Trustees regularly review the continuing suitability of the Scheme’s investments including the appointed Provider and the funds utilised, and these may be amended from time to time. However, any such adjustments would be done with the aim of ensuring the overall level of risk is consistent with that targeted.

Details of the appointed Provider and the funds available can be found in a separate document produced by the Trustees entitled “Investment Policy Implementation Document”, which is available to members on request.

8. Expected Return

The funds available are expected to provide an investment return relative to the level of risk associated with it. The Trustees believe that the range of funds offered should provide a range of potential returns that are suitable for the membership as a whole. The expected return targeted by each fund is shown in the “Investment Policy Implementation Document”.

9. Arrangements with Asset Managers

The Trustees appoint investment managers based on their capabilities and, therefore the perceived likelihood of achieving the expected return and risk characteristics required for the asset class being selected. The Trustees look to their investment advisor for a forward looking assessment of a manager’s ability to outperform over a full market cycle. The advisor’s manager research ratings assist with due diligence and questioning managers during presentations to the Trustees and are used in decisions around selection, retention and realisation of manager appointments.

As the Trustees invest in pooled investment vehicles they accept that they limited ability to influence investment managers to align their decisions with the Trustees’ policies set out in this Statement. However, appropriate funds can be selected to align with the Trustees’ overall investment strategy. If the investment objective of a particular fund changes, the Trustees will review the use of that fund to ensure it remains appropriate and consistent with the Trustees’ wider investment objectives.

The Trustees expect investment managers to incorporate the consideration of longer term factors, such as ESG factors, into their decision making process where appropriate. Voting and engagement activity should be used by investment managers to discuss the performance of an issuer of debt or equity. The Trustees also consider the investment adviser’s assessment of how each investment manager embeds ESG into its investment process and how the manager’s responsible investment philosophy aligns with the Trustees’ responsible investment policy. The Trustees will use this assessment in decisions around selection, retention and realisation of manager appointments.

The Trustees’ focus is on longer-term performance but shorter-term performance is monitored to ensure any concerns can be identified in a timely manner. The Trustees review both absolute and relative performance against a portfolio or underlying investment manager’s benchmark on a quarterly basis, including assessments of both shorter and longer time horizons. The Trustees also rely upon Mercer’s manager research capabilities. The remuneration for investment managers used by the Scheme is based on assets under management. The levels of member borne fees, which include investment manager fees, are reviewed annually as part of the annual value for members assessment to ensure they continue to represent value for members. If performance is not satisfactory, the Trustees may request further action be taken, including a review of fees.

Portfolio turnover costs for each of the funds are reviewed on an annual basis as part of the annual value for members assessment. The ability to assess the appropriateness of these costs is currently limited by the availability of data and the lack of industry-wide benchmarks. The Trustees will monitor industry developments in how to assess these costs and incorporate this in future value for members assessments. Importantly, performance is reviewed net of portfolio turnover costs.

The Trustees are long term investors. All funds are open-ended and therefore there is no set duration for manager appointments. The Trustees are responsible for the selection, appointment, monitoring and removal of the investment managers. The available fund range and Default Investment Option are reviewed on at least a triennial basis. The Trustees will cease using a fund if it is no longer considered to be optimal nor have a place in the default strategy or general fund range.

10. Compliance with this Statement

The Trustees will monitor compliance with this Statement annually, or immediately after any change in strategy. In particular they will obtain written confirmation from the Provider that they have given effect to the investment principles in this Statement so far as reasonably practicable and that in exercising any discretion the investment managers have done so in accordance with Section 4 of The Occupational Pension Scheme (Investment) Regulations 2005.

11. Review of this Statement

The Trustees will review this Statement at least once every three years and without delay after any significant change in investment policy. Any change to this Statement will only be made after having obtained and considered the written advice of someone who the Trustees reasonably believe to be qualified by their ability in and practical experience of financial matters and to have the appropriate knowledge and experience of the management of pension scheme investments.

This Statement of Investment Principles was formally adopted by the Trustees of the NATS Defined Contribution Pension Scheme on 26th August 2020